Discover how Dover Heights homes gained $1,100+ daily in value. Learn why trading within Sydney’s East may not unlock wealth and explore smarter moves

Sydney’s Eastern Suburbs remain one of the strongest performing residential markets in the country, with homes in suburbs like Dover Heights, Bellevue Hill, Bronte, and Vaucluse regularly rising by over $1,000 a day in value. For long-time owners, this extraordinary capital growth has created life-changing, tax-free wealth. But here’s the catch: if you sell and buy again within the same market, that “paper profit” doesn’t always translate into a better lifestyle.

A Real-Life Example: Dover Heights Growth Story

Take Alex and Diana, who purchased their Dover Heights family home in 2012 for $2.71 million. Thirteen years later, the property is estimated at around $8 million. That’s a capital gain of $5.29 million — or around $1,115 per day since settlement.

On paper, they’ve achieved the dream outcome: financial security, tax-free profit under the principal residence exemption, and the option to cash out. But while the property feels oversized for their needs now, the challenge is what comes next.

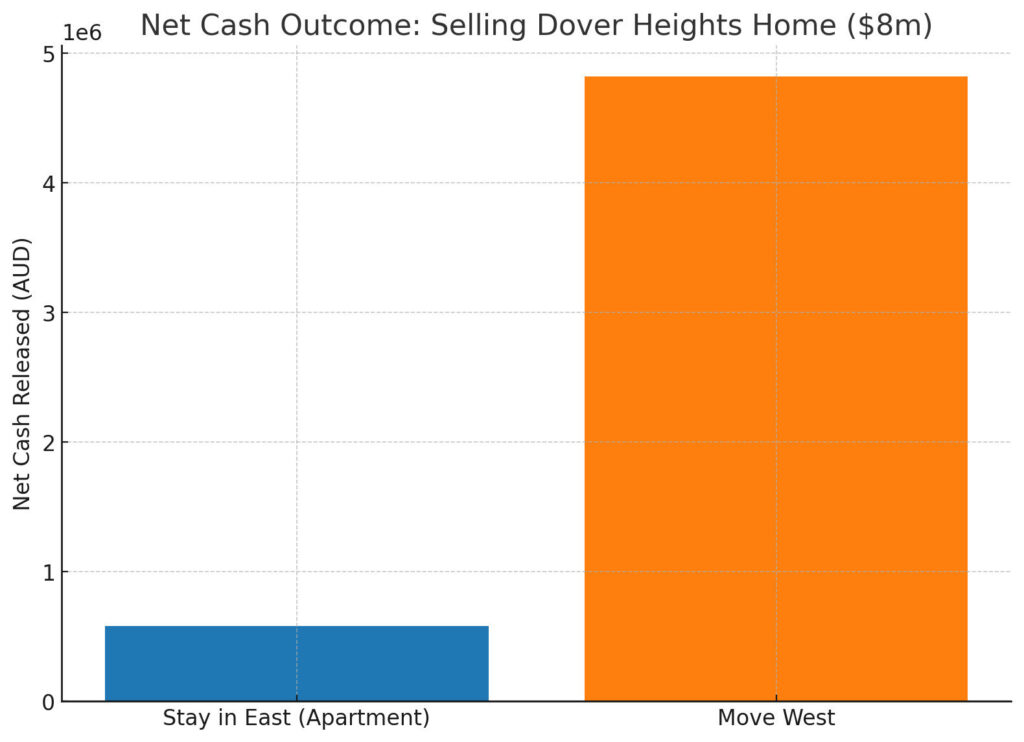

- If Alex and Diana chose to “downsize” to a modern three-bedroom apartment in the same area, they’d likely face a price tag north of $7 million.

- Add stamp duty of over $400,000, and their net gain from selling isn’t nearly as compelling.

- In fact, the “trade” barely frees up any cash, once you factor in costs.

This is the hidden truth many Eastern Suburbs owners are discovering: unless you’re prepared to move further west, interstate, or even overseas, much of the capital growth is locked into the market itself.

The $1,000-a-Day Boom

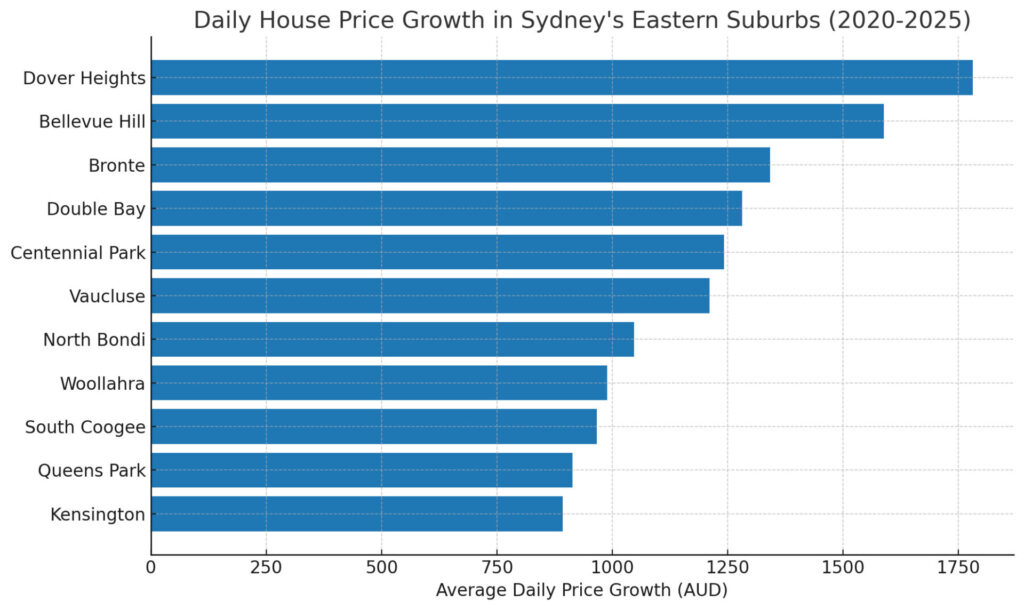

Over the past five years, Sydney has led the nation in price acceleration. According to PropTrack and ABS data, suburbs like Dover Heights, Bellevue Hill, Bronte, and Vaucluse have consistently averaged between $1,000 and $1,700 in daily price growth.

- Dover Heights: +$1,781/day

- Bellevue Hill: +$1,589/day

- Bronte: +$1,342/day

- Vaucluse: +$1,211/day

- North Bondi: +$1,047/day

This rapid appreciation has been driven by a perfect storm: record migration, under-building of new homes (60,000 short last year alone), surging construction costs, and buyers competing aggressively for limited supply.

The Lifestyle Dilemma for Long-Term Owners

What does this mean for families in the Eastern Suburbs?

- Trading sideways is costly: Selling your home and buying within the same market often leaves you in a similar financial position, once stamp duty, moving costs, and transaction fees are deducted.

- True downsizing often requires relocation: To unlock real cash, many owners look to Sydney’s west, coastal regional areas, or interstate markets like Queensland, where their equity stretches further.

- Timing matters: While growth has been remarkable, the cycle also compounds costs. Owners upgrading or downsizing within the same five to ten suburbs are effectively competing with themselves.

Strategy: How to Maximise Your Equity

For Alex and Diana, and many others in Dover Heights, Vaucluse, or Bronte, the key is clarity of purpose. If the goal is lifestyle — a smaller home, less maintenance, a coastal move — then selling makes sense. If the goal is financial freedom, sometimes the smarter move is to exit the Eastern Suburbs premium and redeploy capital elsewhere.

Some clients choose to:

- Sell and buy a luxury apartment in a more affordable coastal city like the Gold Coast or Sunshine Coast.

- Move west within Sydney, where a high-end home still costs less than a Bellevue Hill apartment.

- Retain their Eastern Suburbs property as a wealth anchor while leveraging equity into investment opportunities elsewhere.